Division of

Student Success

Connecting Life + Learning at Clark

Your education doesn’t start and end in the classroom. At the Division of Student Success, we are here to connect you, challenge you, and support you across all aspects of your life, on campus and beyond — your education, health and well-being, career preparation, and co-curricular activities.

Ensuring Your Success

Community Living

Connect with others and find your home, whether you’re living on campus or commuting to Clark.

Career Readiness: Exploration, Internships & Employment

Pursue jobs and internships to reach your goals.

Engagement & Belonging

Join a club, meet new people, and stay active.

Health & Well-Being

Eat, rest, and take care of your body, mind, and spirit, and access the resources you need.

Inclusive Academic Excellence: Academic Advising & Support

Chart your path and fine-tune your study skills.

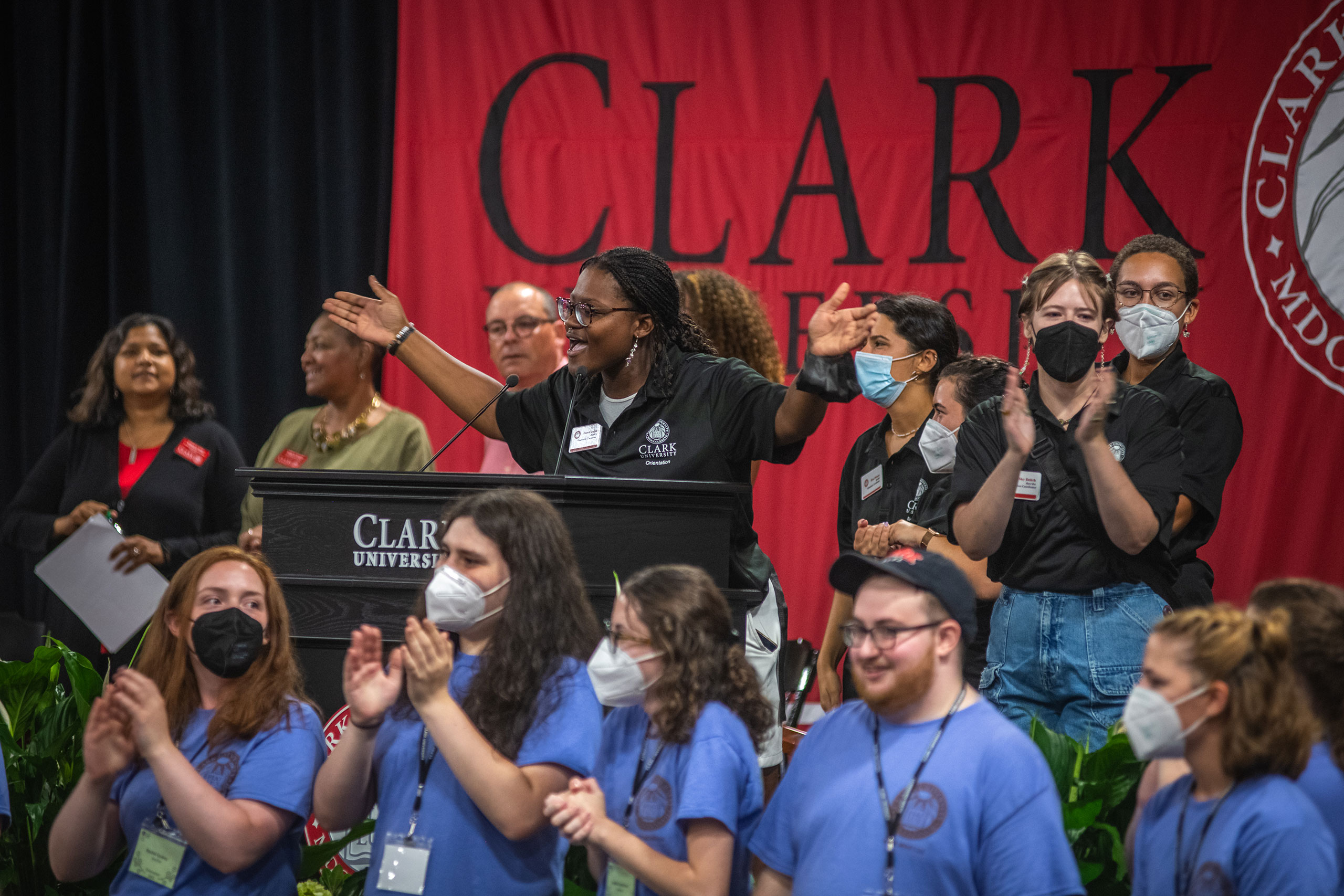

First-Year & Transfer Experiences

Get the most out of Clark, from the very start.

Care Team

Have a concern or crisis that is getting in the way of your success?

The Care Team is here for you.

Our Guiding Principles

We espouse a set of ethical aspirations through our why, vision, and values to guide our day-to-day actions and decision-making. These ground the way we do our work, communicate and collaborate within the Clark community, and support student growth and development.

Campus Activities

Find events, join a club, connect with your peers.